Performance Management

Performance management is a key aspect of management accounting and involves the following:

assigning responsibility - is the manager of a division responsible for costs, revenues and investment or just cost control?

setting up a system of performance measures and targets

reviewing performance and acting accordingly

The choice of targets - critical success factors

Critical success factors (CSFs)

Critical success factors (CSFs) are the vital areas 'where things must go right' for the business in order for them to achieve their strategic objectives. The achievement of CSFs should allow the organisation to cope better than rivals with any changes in the competitive environment.

The organisation will need to have in place the core competencies that are required to achieve the CSFs, i.e. something that they are able to do that is difficult for competitors to follow.

There are five prime sources of CSFs:

(1) The structure of the industry- CSFs will be determined by the characteristics of the industry itself, e.g.in the car industry 'efficient dealer network organisation' will be important where as in the food processing industry 'new product development' will be important.

(2) Competitive strategy, industry position and geographic location

- Competitive strategies such as differentiation or cost leadership will impact CSFs.

- Industry position, e.g. a small company's CSFs may be driven by a major competitor's strategy.

- Geographical location will impact factors such as distribution costs and hence CSFs.

(3) Environmental factors - factors such as increasing fuel costs can have an impact on the choice of CSFs.

(4) Temporary factors - temporary internal factors may drive CSFs, e.g. a supermarket may have been forced to recall certain products due to contamination fears and may therefore generate a short term CSF of ensuring that such contamination does not happen again in the future.

(5) Functional managerial position - the function will affect the CSFs, e.g. production managers will be concerned with product quality and cost control.

Key performance indicators (KPIs)

Key point: Things that are measured get done more often than things that are not measured

The achievement of CSFs can be measured by establishing key performance indicators (KPIs) for each CSF and measuring actual performance against these KPIs

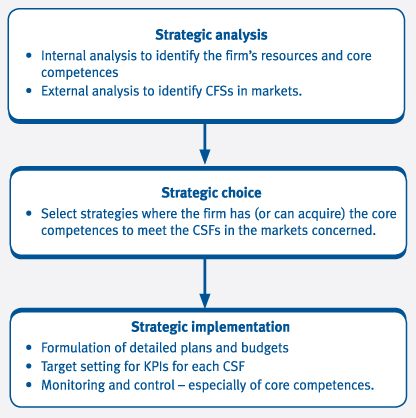

CSFs and KPIs as part of the strategic planning process

The choice of targets - behavioural aspects

At the top of a heirarchy of objectives will be the mission statement and strategic objectives. These will be translated into tactical objectives and then into detailed operational targets for individuals. The intent is that enabling individuals to hit their targets will ultimately ensure the proposed strategy is successful.

Targets should be:

- Relevant to the organisation's overall objective, e.g. if the organisation has an objective of 100% quality then an individual production worker maybe set a target to produce products with zero defects. (It is worth noting that quality initiatives are often undermined by targets that focus on short term profits).

- Achievable - employees may be unmotivated if they consider targets are very difficult or impossible to achieve, e.g. zero defects may be seen as impossible. However, it is worth noting that the same may be true if targets are too easy to achieve.

- Controllable - the individual will be unmotivated if they feel they can't control the target set, e.g. a production worker may not be responsible for defects if poor quality materials are purchased.

- Prioritised - employees will be overwhelmed and hence unmotivated if they are set a large number of targets.

Your FeedbackWe value your feedback on the topics or anything else you have found on our site, so we can make it even better.Give Feedback The choice of targets - financial and non-financial indicators

Many organisations focus primarily on financial performance indicators. However, there are a number of problems associated with the use of financial performance indicators to monitor performance that imply that firms should use non-financial performance indicators as well:

Confusing cause and effect

We may be able to see that profits have fallen and this is due to reduced revenue but we are more interested in why sales have been lost - is it due to quality problems, for example. Causes are often non-financial.

Short-termism

Linking rewards to financial performance may tempt managers to make decisions that will improve short-term financial performance but may have a negative impact on long-term profitability. E.g. they may decide to cut investment or to purchase cheaper but poorer quality materials.

You could argue that this is a danger with all targets, whether financial or non-financial. However, the risk of short termism is much greater with financial measures.

Manipulation of results

In order to achieve the target financial performance and hence their reward, managers may be tempted to manipulate results. For example:

- Accelerating revenue - revenue included in one year may be wrongly included in the previous year in order to improve the financial performance for the earlier year.

- Delaying costs - costs incurred in one year may be wrongly recorded in the next year's accounts in order to improve performance and meet targets for the earlier year.

- Understating a provision or accrual - this would improve the financial performance and may result in the targets being achieved.

- Manipulation of accounting policies - for example, closing inventory values may be overstated resulting in an increase in profits for the year.

As with the above comments on short termism, the risk of manipulation is much greater with financial measures than non-financial ones.

Do not convey the full picture

The use of these short-term financial performance indicators has limited benefit to the company as it does not convey the full picture regarding the factors that will drive long-term profitability, e.g.customer satisfaction, quality.

Therefore, when monitoring performance, a broader range of measures should be used. Many critical success factors, such as quality, are best measured via non-financial measures.

Wrong signals and inappropriate action

A performance management system that is badly designed or which is applied in an insensitive manner may end up doing more harm than good.

There are many ways in which poorly designed systems can result in wrong signals and dysfunctional behaviour.

Berry, Broadbent and Otley identified the following problem areas:

- Misrepresentation - 'creative' reporting to suggest that a result is acceptable.

- Gaming - deliberate distortion of a measure to secure some strategic advantage.

- Misinterpretation - failure to recognise the complexity of the environment in which the organisation operates.

- Short-termism - leading to the neglect of longer-term objectives.

- Measure fixation - measures and behaviour in order to achieve specific performance indicators which may not be effective.

- Tunnel vision - undue focus on stated performance measures to the detriment of other areas.

- Sub-optimisation - focus on some objectives so that others are not achieved.

- Ossification - an unwillingness to change the performance measure scheme once it has been set up.

Further aspects

Related areas of particular interest are performance management in not for profit organisations and divisional performance management.

|

Created at 8/8/2012 10:52 AM by System Account

(GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London

|

Last modified at 9/13/2013 10:45 AM by System Account

(GMT) Greenwich Mean Time : Dublin, Edinburgh, Lisbon, London

|

|

|

|

|

Rating

:

|

Ratings & Comments

(Click the stars to rate the page) Ratings & Comments

(Click the stars to rate the page)

|

|

Tags:

|

|

|

|

|